For academics: research design to study the gender dimension in financial markets

This page explains how academics could use our research design to study the gender dimension in financial markets. With the SimTrade market simulations used in the experiments, you can get relevant data about the behavior of market participants such as trading behavior, learning behavior, profile, etc.

We explain below how we used market simulations for our research article Is Gender in the Pocket of Investors? Identifying Gender Bias Towards CEOs with a Lab Experiment.

Research design

To test the hypothesis that the market is ‘gendered’, we design a simulation-based lab experiment where participants trade their portfolio (cash and stocks) on a company and react to the news flow, which is a series of events about the company that may unfold during the day. Among these events, the focus of this research is on the following gender-related event: the announcement of the next CEO, who in the simulations, may be either a man or a woman. By randomizing the CEO gender at the launch of the simulation, following the CEO announcement, we can identify the participants’ trading reactions according to the CEO gender. The participants’ trading decision to buy or sell stocks signals their beliefs or expectations regarding the new CEO’s impact on future firm performance.

We adopt a two-dimensional approach to gender: we study both the gender of the CEO and the gender of market participants. Using experimental simulations in a controlled environment, following the CEO appointment, we analyze the market reaction according to the gender of the CEO and, crucially, according to the gender of the market participants.

Experimental design

Experimental economics uses laboratory methods to study phenomena that are difficult to observe directly in the real world. Experiments classically contain factors (process variables) used to observe changes on outcomes (response variables). In our experiment, to keep it as simple and clear as possible, we use only one factor of interest: a gender-related event—the appointment of the CEO who can be either a man or a woman. The change in the factor (the independent variable) is hypothesized to result in a change in the outcome (the dependent variable). In our experiment, the outcome of interest is the trading activity of the participant just after the announcement of the appointment of the future CEO. In particular, we are interested in the participants’ buying or selling decisions reflecting after the event their attitude towards the CEO’s gender.

Choice of experimental design

There are two different methods to design an experiment: the between-subject and the within-subject design. Both design methods have their advantages and drawbacks. The main point to consider when choosing the design method is the importance of the “demand effect”, which is a spurious effect reflecting the attempt of participants to behave to satisfy their perception of the experimenter’s expectations. By changing the value of a parameter from one experiment to another, the participant understands what the experiment is about. In our case, by changing the gender of the CEO between the two consecutive simulations, the participant would understand that the experiment is about gender stereotypes in leadership. For our design experiment, to avoid a “demand effect”, we then decided to adopt a between-subject design.

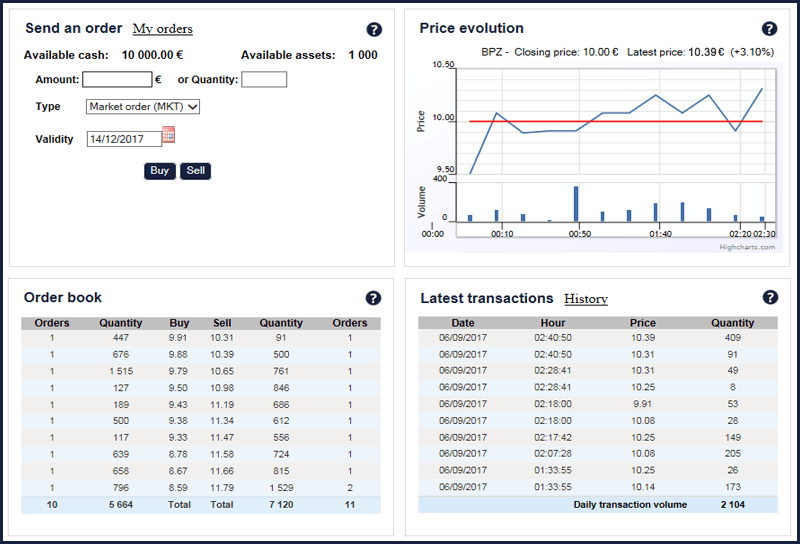

Realistic simulation tool

To carry out our research, we use an on-line trading simulation platform called SimTrade. In terms of experimental design, compared to traditional out-of-context experiments (such as lotteries used to measure preferences), the added value of SimTrade is contextualization: similar to traders in an investment bank, participants in the simulation can buy and sell stocks of a company in reaction to stock market price fluctuations and economic news. The experiment conducted by using the SimTrade simulation platform then provides a realistic environment to study the decisions taken by the participants of the experiment.

Experimental setting

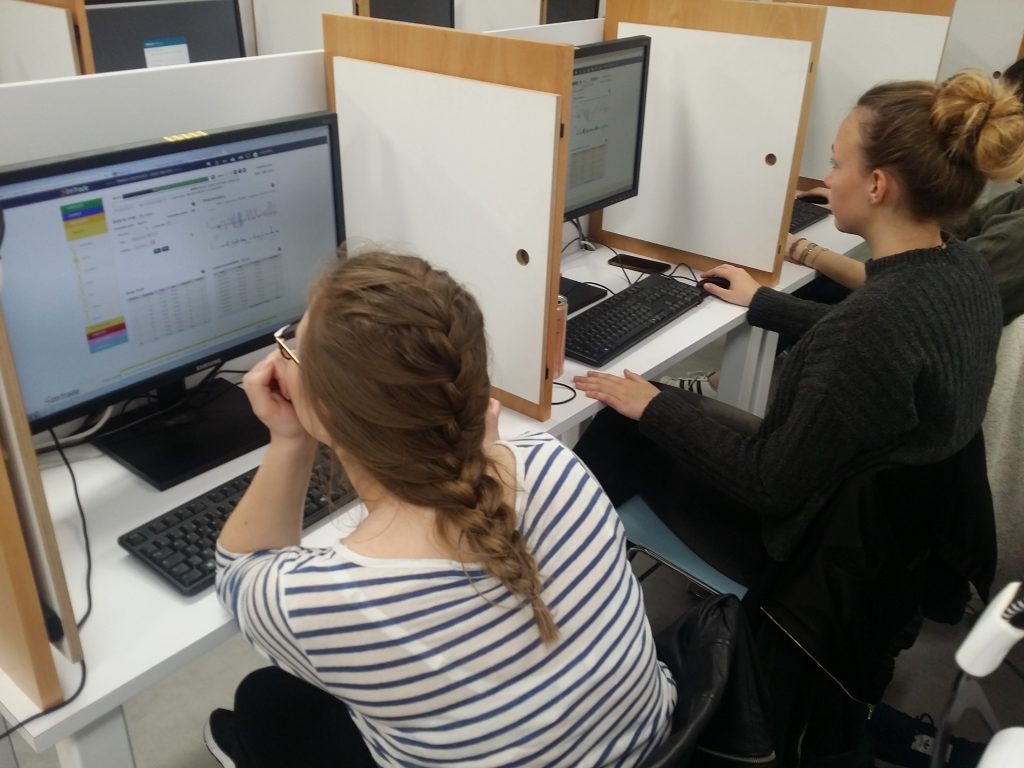

The experiment was carried out in the ESSEC experimental research lab designed for conducting experiments in a controlled environment. The experiment was presented to students as an opportunity to contribute to a research project studying how economic agents make their financial decisions. Following common practice, the gender aspect of the research project was not revealed to participants to avoid disclosing our research subject.

At the beginning of the experiment, the participants are required to read the description of the scenario, which includes a description of the firm, a brief history of the stock price, the events expected to occur during the trading session (the appointment of the next CEO is one of the events presented) and the market consensus by financial analysts. The participants are presented the sequence of events that may unfold during the simulation. This sequence includes two major events: a gendered event—the CEO appointment —and a nongendered event—the result of a tender offer. The nongendered event takes place after the CEO appointment and serves as a placebo check to study the robustness of our results. Prior to the announcements of these events, the participants are uninformed about their final outcome. Regarding the gendered event, while they know that the company is going to announce the next CEO, they do not know who will be appointed. Regarding the nongendered event, while they know that the result of the tender offer will be announced during the day, they do not know whether SunCar will win it or not. Participants are asked to act as investors whose objective is to maximize their gains out of the trading day, something of which they are clearly reminded at the start of the simulation. As an incentive, participants receive compensation in the form of a course grade bonus derived as a function of their realized gains during the simulation. The participants, who have followed the core finance course, are familiar with the functioning of financial markets, but this is the first time that they launch the simulation used for our experiment.

Internal and external validity

Our simulation-based lab experiment allows us to measure the behavior of participants at the disaggregated level: their trading activity during the simulation and their profile (gender, age, educational attainment, and other personal information). Such an approach increases the internal validity of our results obtained in a controlled environment by controlling the proportion of CEO, the timing of the events, and the disclosure of information and detailed data about market participants (crucially their gender).

This high internal validity comes at the cost of potentially lower external validity. Typically, in experimental research, a single study on its own cannot improve on this trade-off. However, the experiment that we developed on the SimTrade application is available for the research community upon request. As part of future work, our experiment could be implemented in different environments. This would be particularly useful to increase the external validity of our results. In our case, this seems even more needed and potentially interesting because countries vary greatly in terms of gender inequality both at the societal level and in the financial sector.

Example of academic research

You can read our research article Is Gender in the Pocket of Investors? Identifying Gender Bias Towards CEOs with a Lab Experiment by François Longin and Estefania Santacreu-Vasut. This article is based on the experiments conducted with ESSEC students.

Contacts

Prof. François Longin

Finance Departement – ESSEC Business School

E-mail: longin@essec.edu

Prof. Estefania Santacreu-Vasut

Economics Department – ESSEC Business School

E-mail: santacreuvasut@essec.edu