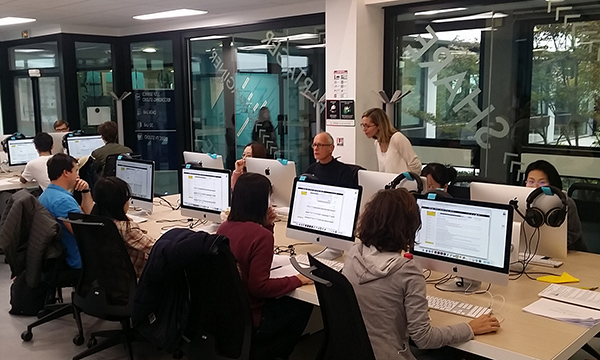

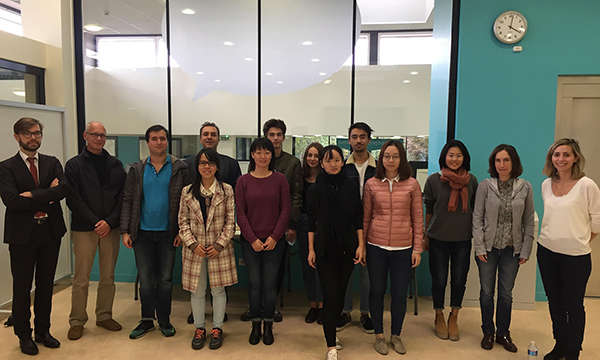

The Gender & Finance Workshop took place on Friday October 14th 2016 at ESSEC Business School K-Lab located in ESSEC Cergy campus. The workshop was part of the ESSEC Involvement week 2016.

Organized by Professor François Longin and Professor Estefania Santacreu-Vasut, from the Finance and Economics department respectively, the workshop attracted a varied audience from diverse backgrounds.

Gender & Finance workshop:

simulations using SimTrade and discussion around gender in finance

The workshop was organized in two parts: first, participants were invited to participate to an experiment in financial markets to test if gender stereotypes influenced their financial decisions; second, we debriefed the experiment, shared some statistics about the choice of studies and careers by ESSEC students and organized a debate around the issue of gender in finance.

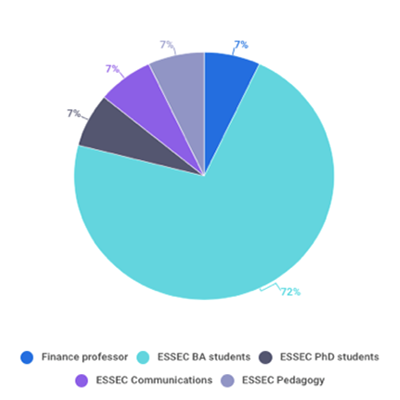

Gender & Finance participants background (morning session)

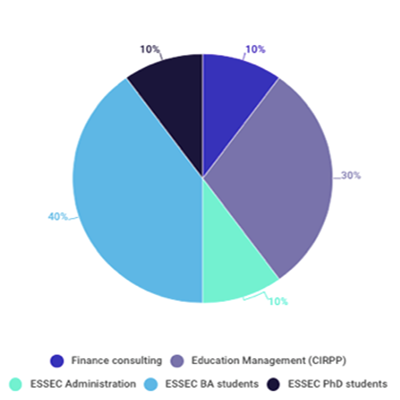

Gender & Finance participants background (afternoon session)

These workshops are a fundamental part of the project Gender & Finance, which mission statement is to “unblinding gender in finance: from the classroom to the trading floor”. In other words, we think that taking into account the “gender” dimension, in the academic world – in the classroom – and in the business world – in the trading room –, can bring value for society.

One of the reasons that pushed us to investigate students’ reaction to gender related news in the context of finance was that we realized that few female ESSEC students choose to specialize in finance during and after their studies although there are as many female as male students, and more importantly, female students tend to perform better in the classroom. We also realized that our finance curriculum was gender blind and that this was probably the case of the financial industry as well. We then decided to follow an experimental approach using the simulation tool SimTrade, which main advantage is to contextualize a financial experiment with social factors to create these workshops.

Experiment in financial markets

We present below recent results from our research in gender and finance.

SimTrade

We use the SimTrade simulation platform freely available on www.simtrade.fr. SimTrade is a tool used to teach and learn finance, and a tool used for research to conduct experiments to better understand the behavior of individuals in terms of financial decisions.

We use the SimTrade simulation platform freely available on www.simtrade.fr. SimTrade is a tool used to teach and learn finance, and a tool used for research to conduct experiments to better understand the behavior of individuals in terms of financial decisions.

The originality of SimTrade is to propose simulations with a platform to buy and sell stocks. Like traders in a trading room of an investment bank, SimTraders live a full trading day (10 minutes at your watch) with exciting trading opportunities, stock market prices going up and down, positive and negative news announcements about firms and in the economy that have to be interpreted.

SunCar simulation

To study the gender issue in finance, we build the SunCar simulation. SunCar is a company, which designs, produces and sells low-speed electric vehicles for city use. Due to a severe illness, Jacques Dallara, the CEO, will be relinquishing his operational duties in the near future. During the simulated trading session, at midday, SunCar is expected to announce the name of Jacques Dallara’s successor as head of the group. The two candidates for his replacement are: Anna Farrell and Henri Villa.

To study the gender issue in finance, we build the SunCar simulation. SunCar is a company, which designs, produces and sells low-speed electric vehicles for city use. Due to a severe illness, Jacques Dallara, the CEO, will be relinquishing his operational duties in the near future. During the simulated trading session, at midday, SunCar is expected to announce the name of Jacques Dallara’s successor as head of the group. The two candidates for his replacement are: Anna Farrell and Henri Villa.

For our experiments based on simulations, we have randomized the simulations: when the SimTrader launches the simulation, he or she will play sometimes the simulation where Anna Farrell is nominated to be the next CEO, and sometimes the simulation where Henri Villa is nominated to be the next CEO (the probability of each variant being equal to 50%). This gender-related event allows us to capture the behavior of SimTraders: would you sell, buy or do nothing after the news announcement of the next CEO?

Debriefing of the experiment

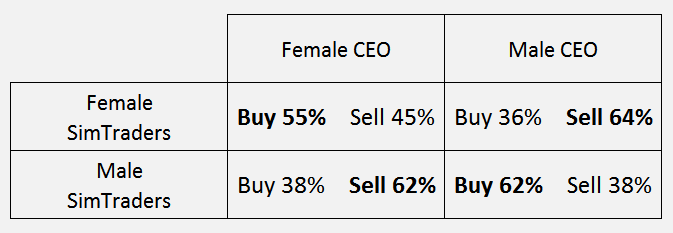

What participants did after the news announcement of the new CEO? Was there a difference if a female CEO or a male CEO is appointed? Does this difference depend on the gender of participants (SimTraders)? Their behavior during the simulation is summarized by the table below:

What do we observe? When Anna Farrell – a female CEO – is nominated, female traders react more positively to this news announcement as there are 55% of buyers and 45% of sellers among them. On the opposite, male traders react more negatively to this news announcement as there are 38% of buyers and 62% of sellers. When Henri Villa – a male CEO – is nominated, results are reversed: female traders react more negatively to this news announcement as there are 36% of buyers and 64% of sellers among them. On the opposite, male traders react more positively to this news announcement as there are 62% of buyers and 38% of sellers.

The discussion was also about the interpretation of the results: did SimTraders buy/sell because they thought that it was a good/bad news for the SunCar company? Did SimTraders buy/sell because they thought that it was a good/bad news for the stock price of SunCar shares? Did SimTraders buy/sell because they thought that other market participants thought it was a good/bad news for the stock price of SunCar shares? An end-of-simulation survey allowed to disentangle all these effects.

In particular, we discussed the reasons for which participants bought or sold stocks after the announcement that a female CEO was appointed, some participants emphasized a dilemma between following their assessment of the news and anticipating the market reaction (other’s assessment). While some clearly stated they had no negative stereotype concerning female managers, they sold stocks in reaction to their expectation that the market would react negatively to the news. Other participants, such as Claire Le Moël from the CIRPP mentioned, « I went from convention to conviction » explaining why she decided to buy stocks in reaction to the news of the appointment of a female CEO.

Thanks to our workshop, we engaged in a discussion regarding the potential decision-making biases related to gender and the impact on society. Indeed, from a purely quantitative perspective, recent estimates point out at significant gains from increased gender equality. For instance, a recent study (McKinsey Global Institute 2015) quantifies the gains from gender equality would add $12 trillion to global growth. While such studies focus mostly on economic gains, these gains can also be symbolic and qualitative as such advances may foster a trust in the potential for anyone to thrive, regardless of gender and of other socio-demographic characteristics.

Contacts

Prof. François Longin

Finance Departement – ESSEC Business School

E-mail: longin@essec.edu

Prof. Estefania Santacreu-Vasut

Economics Department – ESSEC Business School

E-mail: santacreuvasut@essec.edu